BASICS OF LIFE INSURANCE|LIFE INSURANCE 101

Have you always wanted to invest in a life insurance package but don’t know where to start? Instead of living a lifestyle where you work a 9-5 job to earn money and spend recklessly, why don’t you go and invest in a life insurance package to secure your future!

Committing yourself to regularly spend money on something you can’t instantly have seems like an uninteresting or unnecessary waste of money, but if you take time to study and learn what life insurance is really about, then you’ll understand that it’s not a waste of your hard earned money at all so before investing for life insurance, you should know what it is.

Essentially, life insurance is a service or a product provided by an insurance company to financially support your loved ones, and your family in case something bad happens to you that leaves you unable to work anymore. It can act as an income replacement that would support your everyday budgetary needs or even your child’s education.

Proceeds from insurances can also help you pay for your house’s mortgage or your car loan. Life insurance can also act as your inheritance for your beneficiaries.

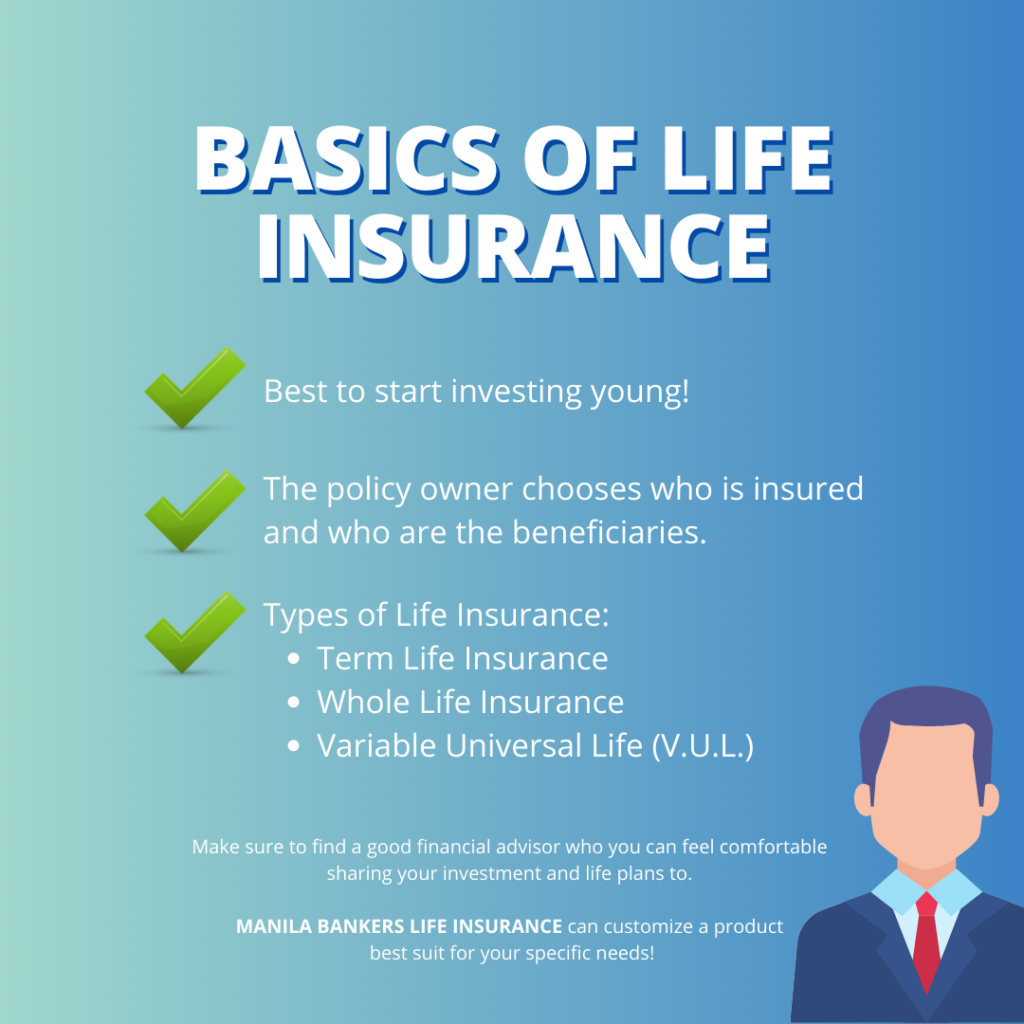

You may have already heard by now that it is better to start investing for life insurance when you’re young. This is true because you’re most likely to have health complications when you are old than when you are young so your premium is much cheaper when you start early preferably in your 20s or 30s. Premium is the payment you make for the insurance policy.

Insurance policy is the contract between the insurance company and the policy owner (you). The policy owner chooses who is insured and who are the beneficiaries. It also depends on the insurance policy on how you are going to pay for your premium, it can be a one time payment, yearly, biannual, monthly, or quarterly.

There are also 3 types of insurances that you can avail. These are; Term Life Insurance, Permanent Life Insurance, and Endowment. Let’s go in-depth with each one

Term Life Insurance is the cheapest form of life insurance. It provides the highest coverage for lowest cost however, when the term expires, and the insured is still alive, no benefits will be received. This is also a pure life insurance only, there are no investments, and no additional features. One of its downsides is that it is expensive to renew because by that time, the insured will be significantly older.

Permanent Life Insurance lasts a lifetime/100 years. It also has 2 subtypes. These are:

Whole Life Insurance – this is similar to Term Life Insurance wherein there are no investments and additional features however the difference is this provides lifelong coverage and there is no need for renewal. While it’s not as cheap as term life insurance, it is still fairly affordable.

Variable Universal Life (V.U.L.) – This is one of the more pricey types of insurance but for a good reason! This is insurance plus investment in one, which means every month when you pay for your premium, a portion goes into an investment such as stocks and bonds, and another portion goes to your insurance. You can also withdraw cash from this insurance but is heavily discouraged because it can reduce the benefits for your beneficiaries. Unlike other types of Life Insurance, the policy owner can transfer the assets to their family members without paying the estate tax. This is also the first type of insurance tackled today that includes “riders” or addons, this includes benefits when you encounter unwanted events like critical illness, permanent disabilities and so on.

The last type is Endowment, this is similar to term life wherein policy is effective for a set period of time. But what makes it different is that after the time period and policy owner is still alive he/she can withdraw the money that they invested. This is important because the accumulated money can act as savings. It can be used as funds depending on your needs. The downside is that there are not many returns and for the same amount of coverage, it is much more expensive than term life insurance.

That’s about it for the fundamentals of Life Insurance. Once you figure out what you want you need to find a legitimate and reliable insurance company. One recommendation is Manila Bankers Life Insurance Corporation. They have been around since 1967 and they are duly recognized and authorized by the Philippine Insurance Commission. The company offers a wide array of new and innovative life insurance products, catering to the needs of individuals and groups. The company creates customized life insurance packages based on the requirement of its major and significant customers.

Make sure to also find a good financial advisor who you can feel comfortable sharing your investment and life plans to. Be sure to communicate with each other to make sure that you get the best type of financial insurance for you.