WHY HASN’T COVID-19 LED TO AN INCREASE IN LIFE INSURANCE PROTECTION?

If the COVID-19 pandemic did not happen, what would you be doing today? Most likely, you would be out at the beach basking in the sun and enjoying fresh air not wearing any mask or face shield, or perhaps you are looking forward to your usual night out with friends for a shopping trip to the mall. However, having experienced the difficulties of the past several months that entailed would you still be hankering to splurge your hard-earned money? or would you be a bit wiser with your lifestyle choices?

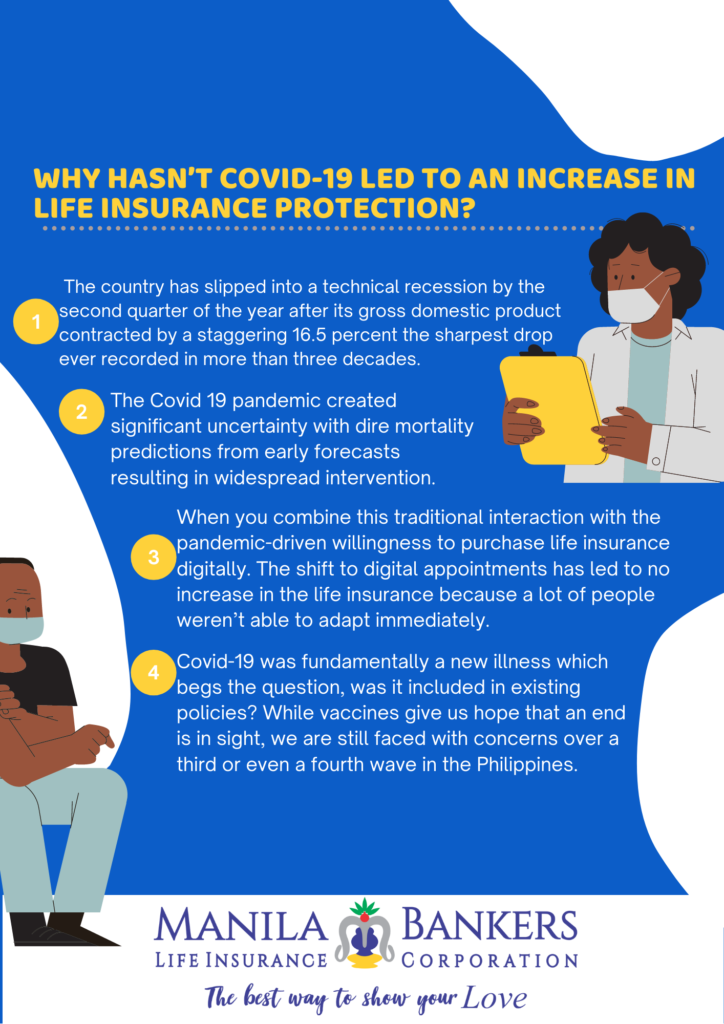

There is one thing for sure, this new normal has impacted not only your health but also your finances. This is because a massive consequence of the lockdowns and community quarantines implemented across the country was the stoppage of work for many Filipinos. In fact, the country has slipped into a technical recession by the second quarter of the year after its gross domestic product contracted by a staggering 16.5 percent the sharpest drop ever recorded in more than three decades.

In March 2020, the uncontrolled spread of the coronavirus in the Philippines lead to fatalities. Covid-19 was a game-changer for the financial services world. Advisers had to adapt their ways from being in a face-to-face communication to digital in a matter of days. Another sector that couldn’t afford to stand still was life insurance, as some of the unfortunate casualties of the pandemic would have had some form of cover or protection.

Covid-19 was fundamentally a new illness which begs the question, was it included in the existing policies? While vaccines give us hope that an end is in sight, we are still faced with concerns over a third or even a fourth wave in the Philippines. The Covid-19 pandemic created significant uncertainty with dire mortality predictions from early forecasts resulting in widespread intervention.

The pandemic got a lot of people thinking about how to increase the financial security of their families, now and in the future and life insurance moved to the top of many to-do lists. If you’re wondering if the pandemic is a good time to be buying life insurance, it is. In fact, because some companies have started raising prices, now is the time to snag a good rate before prices are higher across the board.

Looking forward, one would naturally assume that life insurance sales should increase once the pandemic has waned. When employment is more secure and lockdowns and social distancing a thing of the past, agents and financial advisers can return to face-to-face meetings. When you combine this traditional interaction with the pandemic-driven willingness to purchase life insurance digitally. The shift to digital appointments has led to no increase in life insurance because a lot of people weren’t able to adapt immediately.

Here in the Philippines, especially now in 2021, there are a lot of life insurance providers out in the market, it’s just a matter of doing research and calling representatives. But if you’ve made it this far into this article, here’s a little reward for you. A reputable and reliable insurance company right now is Manila Bankers Life. They are based in Makati, Philippines. Their recognition and authorization by the Philippine Insurance Commissions is a testament to their legitimacy. From 1967, until now 2021 they have been catering to the needs of every Filipinos across the Philippines, and they will surely continue to do so for the many years to come.