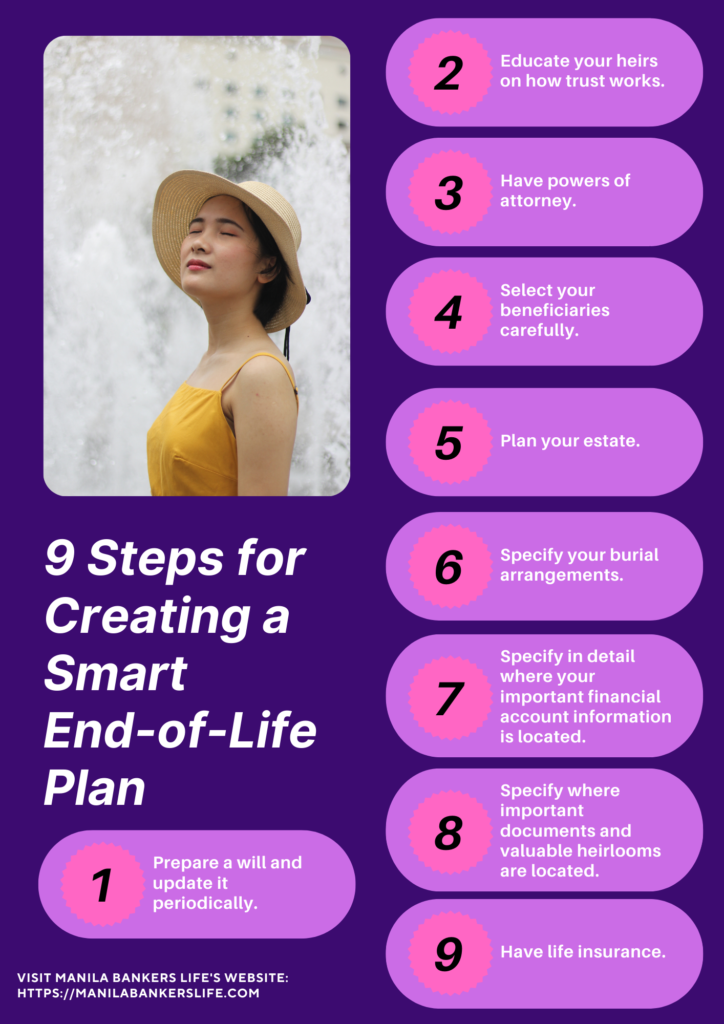

9 Steps for Creating a Smart End-of-Life Plan

Let’s face it, we are going to leave this world and we don’t know when will it happen. As we come to terms with this reality, we have to make sure that we are all prepared, especially for our loved ones when the inevitable comes.

Here are 9 Steps that will help you in creating a Smart End-of-Life Plan that you need to know and consider.

1. Prepare a Will and Update it Periodically.

A will designates executors, guardians, and trustees of your estate. Your executor’s first task is to locate your will and make sure it can be easily accessed by your loved ones when the time comes.

2. Educate your Heirs on How Trust Works.

When we talk about “Trusts” in legal terms, it is a useful legal and estate-planning device for protecting assets from estate taxes and providing a vehicle that ensures survivors get proper administrative and investment advice and counsel. Make sure to seek proper legal assistance about trusts and whether one would be appropriate for you.

3. Have Powers of Attorney.

Typically, a spouse, a close relative, or a friend is usually selected as your financial and healthcare power of attorney who will be authorized to manage your finances.

4. Select your Beneficiaries Carefully

It is important to select your beneficiaries carefully to ensure those named in your insurance policies and retirement plans are still relevant to your needs and wishes. It is also important to review your policies and your will and keep them updated.

5. Plan Your Estate

Arrangements for preparing for death from naming guardians for young children, setting up trusts, and multi-generational planning need to be done with an estate planning lawyer. Experts agree that anyone over the age of 18 should have at least the basics of a death plan in place.

6. Specify Your Burial Arrangements

It is important as well to specify your final arrangements, especially if you wish to be buried or cremated and where your remains will be interred for a certain period. Have a list of professionals who assist you with your family’s legal and financial affairs to make sure all is taken care of.

7. Specify in Detail Where your Important Financial Account Information is Located.

It may sound cliche, but it is important to keep a list of where important records on their savings, retirement plans and insurance reside in an accessible place. Keep a master list and review it annually to check for changes or additions.

8. Specify Where Important Documents and Valuable Heirlooms are Located

Similar to your financial account information, your important documents like your marriage, birth certificates, ids, titles and deeds of sale, passports, and valuable heirloom pieces like jewelry should also be kept and become accessible when the time comes, especially when your remaining loved ones will be processing your post mortem benefits.

9. Have Life Insurance

Life insurance is indeed a proven lifesaver that would help you prepare for the inevitable. Make sure to choose the right life insurance coverage that can help your family even if you’re not there.

Planning for the end of life can feel uneasy, but preparing as much as possible and discussing these items with your family can make all the difference. It can help ease your concerns about the future, ensure your wishes are met, and protect the people you love. Manila Bankers Life Insurance is here to help you show your love to your family and loved ones even if you are no longer in this world.

For more information, please visit Manila Bankers Life‘s website: https://manilabankerslife.com/products.html