Are Life Insurance Benefits Taxable?

Is Manila Bankers life insurance benefits taxable? You may entertain this thought in the future as you get or already have life insurance.

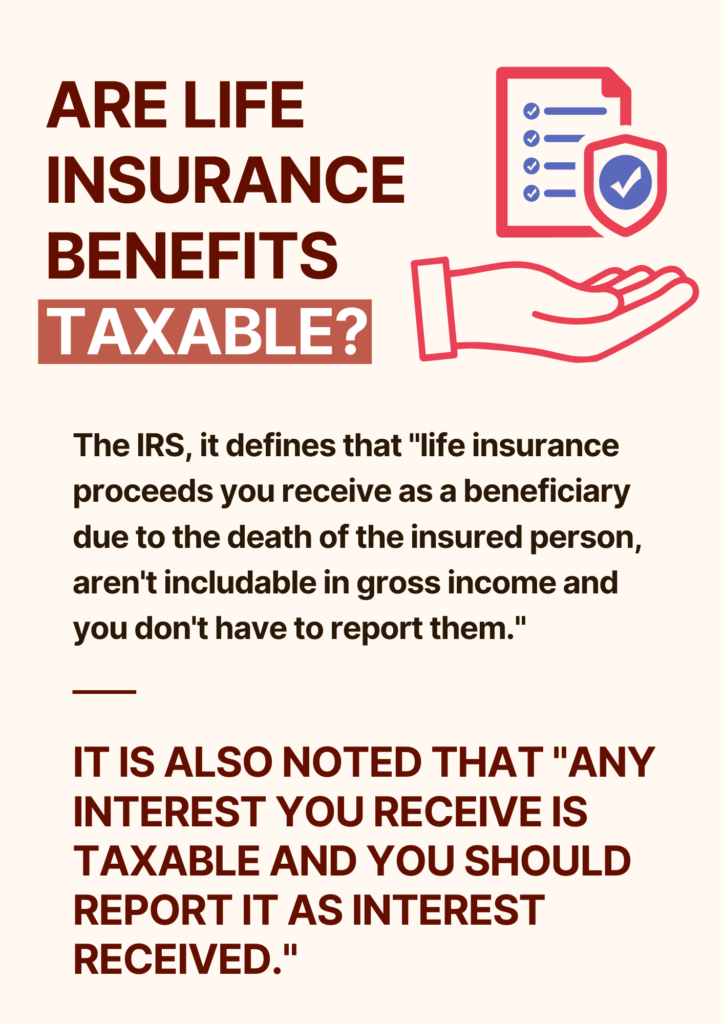

Life insurance‘s advantage is that it isn’t typically taxed. If we checked on the IRS, it defines that “life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income and you don’t have to report them.”

It is also noted that “any interest you receive is taxable and you should report it as interest received.”

At most, life insurance payouts are not taxable. Beneficiaries generally don’t have to report the payout as income, making it a tax-free lump sum that they can use freely.

Life insurance earns cash value over time, which can be withdrawn or borrowed against when you’ve built up enough and as long as the policy is active. For the most part, this cash is tax-deferred, meaning you only pay income taxes on it if you withdraw funds from the policy.

Sinasabi ko sa iyo, hindi ko alam kung ano ang gagawin ko kung wala ang aking Manila bankers life insurance policy.

Napakahirap na mawalan ng aking asawa – husband, ang kumpanya nag padali para ma protektahan ang aking pamilya.

Nakakuha ako kaagad ng coverage, at hindi ko na kailangang harapin ang lahat ng mga papeles sa aking sarili. Inalagaan ng kumpanya ang lahat!